An Affidavit of Death is a legal document used to declare the death of an individual, often required for settling estates or claiming benefits. Using an Affidavit of Death form template simplifies this process by providing a standardized format for the necessary information.

4 min read Asif Khan Written ByContent Editor & Writer Asif is a research expert and seasoned content editor, holding a degree in English Literature and Linguistics. With over three years of professional writing experience, he excels in simplifying complex and technical topics for diverse audiences. At WordLayouts, Asif leverages his expertise to decode intricate templates designed by engineers, ensuring users can fully comprehend and utilize these resources effectively.

An affidavit of death is a legal document that formally announces the death of an individual. Additionally, it allows the transfer of inheritance (property or estate) that the deceased owned. Anyone who knows the deceased personally usually fills out this form.

It has sections for writing the identity of the affiant, the date of death of the deceased, their residence, the purpose of the affidavit, the value of an estate, and more. You can also write the debts and obligations, legal notifications, requests for transfer of assets, and notary acknowledgment.

At some point in life, everyone confronts the loss of a loved one. Family members of a deceased need to fill out and submit such an affidavit of death to various departments for legal compliance and other purposes.

During a time of agony, filling out such a document can be a daunting task. To help you cope with this situation an easily customizable affidavit of death form is provided. It enhances clarity, legal compliance, and accuracy and saves you time.

This form has the following main components that standardize the processes of probate proceedings, transferring property ownership, closing accounts, and legal compliance.

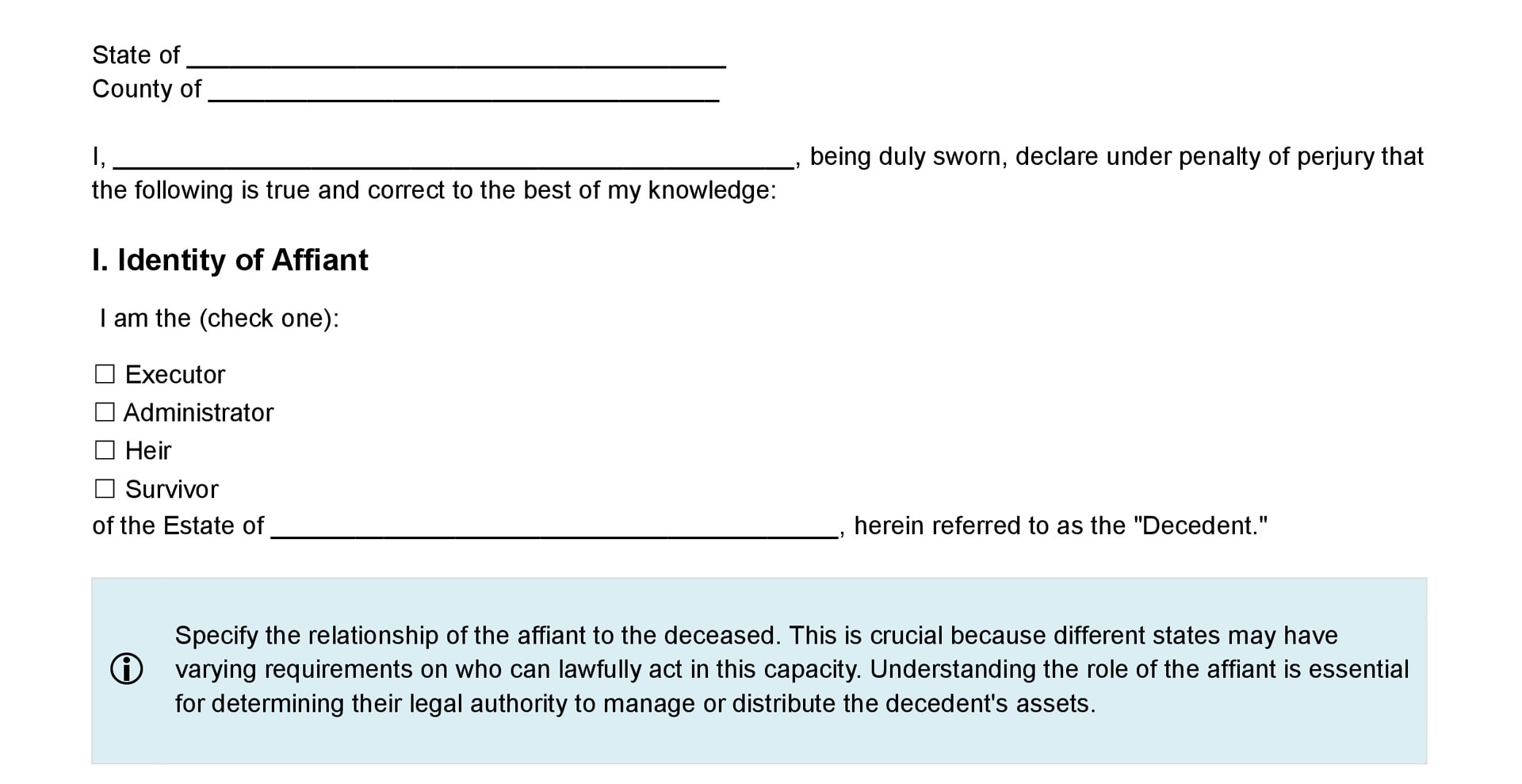

By the start of this affidavit form, the affiant (person making an affidavit) can write the name of the state and county in which they are present. The affiant swears that all the information provided is true and correct by writing their name on the form.

Then the affiant can specify their relation with the decedent which may be the executor, administrator, heir, or survivor. The term executor refers to the person who is named in a will to handle the estate of the deceased. In case there is no executor, then the court appoints an administrator. An heir is a person who is given the property of the deceased as per the law. The term survivor means the individual who outlived the decedent and is entitled to the insurance benefits.

In this section, the affiant can write the date of death of the decedent. It provides clarity, and verification of the death and establishes a timeline.

The place where the decedent was living before the time of their death can be specified here. The legal residency of the decedent can be mentioned here, including their county, state, and the years they spent there before death. You can also write the social security number of the decedent. It helps in the process of jurisdictions, tax implications, and intestacy laws.

Within this section, the affiant can state the purpose of the death affidavit. In this case, it is the transfer or delivery of the assets that belong to the decedent, such as real property, securities, bank accounts, or other assets. Space is provided here for writing the particulars of the other assets. It further enhances clarity, and transparency and mitigates confusion.

Having an idea of the estate’s estimated value can help in probate proceedings, asset management, tax implications, and more. Depending on the value of the estate the state’s taxes may vary. The affiant can write the estimated value of the decedent’s estate within the provided section.

All the debts and obligations that the decedent may have will be applicable per the law. These may include funeral expenses, medical bills, outstanding loans, and other taxes. Writing them down can help in planning, budgeting, and these can serve as informational tools. The affiant ensures that they will be responsible for taking care of all the decedent’s bills and debts.

Informing all the relevant parties such as beneficiaries, successors, and entities concerned about the decedent’s death is crucial because it fulfills the purpose of legal compliance, helps initiate probate, and notifies the heir and creditors. Here, the affiant can affirm that they may stand liable to provide notice to all the parties concerned by the law (the deceased’s spouse, children, parents, siblings, creditors, and government agencies).

Within this section of the form, the affiant requests the transfer of all the assets to the appropriate parties that are entitled to this purpose as per the laws of the state.

A notary acknowledgment involves a notary public, who is a state-commissioned official. The acknowledgment of a notary is crucial because it helps safeguard the legitimacy, reduces the chances of fraud during the inheritance process, and ensures easy transfer of estate to rightful owners.

He verifies the identity of the signer (affiant) and properly approves the verification of the contents of the document. Here, the name of the state and county, including the date, and the name of the affiant is listed. By the end, a notary can write their signature.

Here are some best practices that should be followed before using an affidavit of death form:

The affidavit of death form template serves a great role for the families of decedents. Such forms are submitted to various departments to fulfill legal requirements. This form has an interactive layout and can be easily personalized. It is available in multiple file formats, such as ODT, DocX, DotX, and Google Docs. You can also print it per your needs. It facilitates the overall process of affirmation of an affidavit.